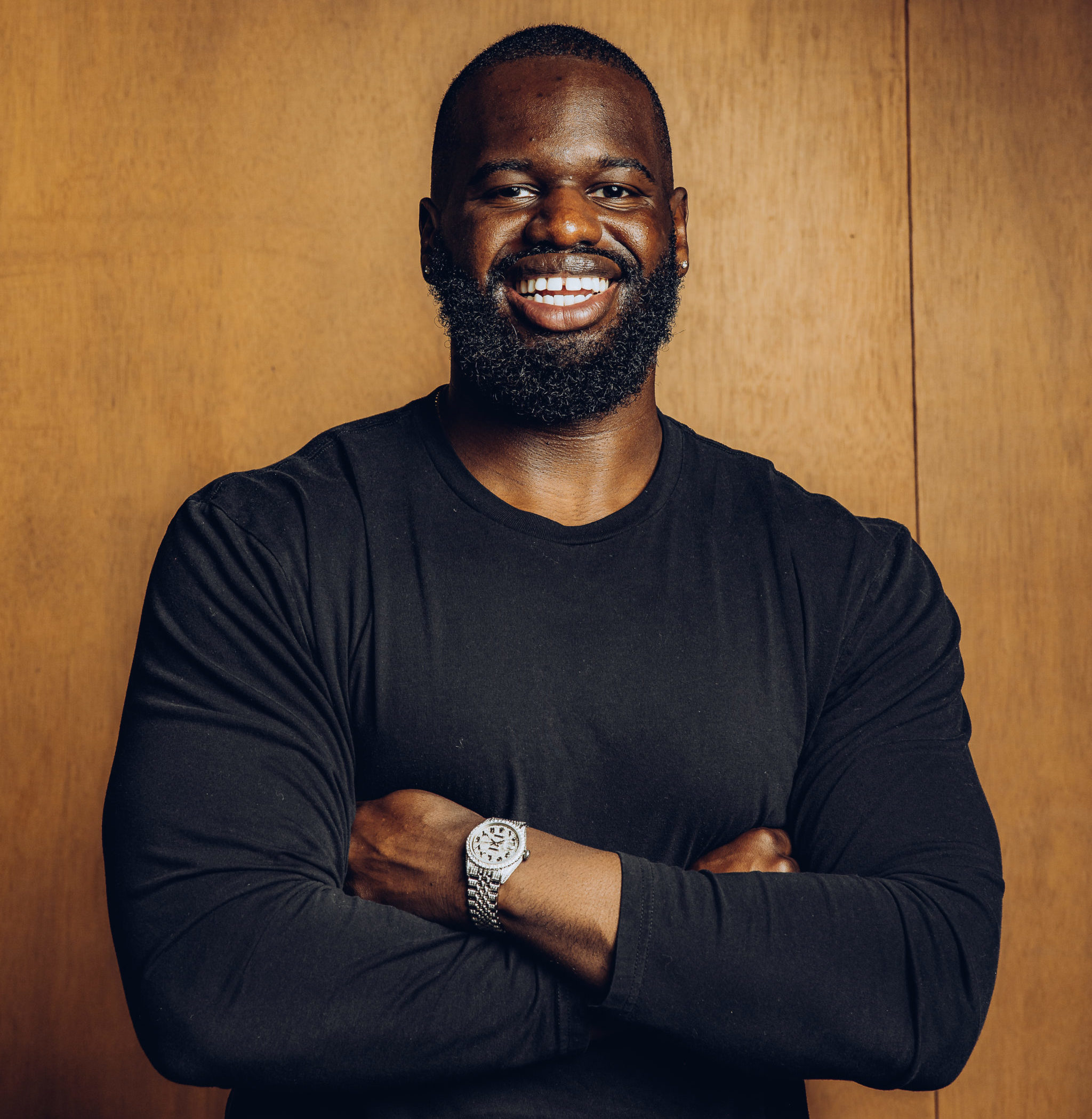

Solo Ceesay is the CEO & Co-Founder of Calaxy.

—

Since I was a boy, I wanted to be a successful businessman. I vividly remember trying on my father’s oversized pastel suits, donning the ubiquitous business look of any dapper-dressed African man of the ’90s. Even before I could form full sentences, I was primed and driven to work in business. With motivation and determination aplenty, my actions were encouraged by relentless sideline cheering from my mother yelling, “You’re a king, Solo!”

Just over a year ago, I took a bet on myself. A bet that a then-26-year-old Black kid could make something out of nothing. And while you could call this journey just about everything but easy, the reality is that raising $26 million with Calaxy was the easy part. The sacrifices I’ve made, the friends I’ve lost, the lack of idols to look up to, and making the decision to take a nose dive into a world of uncertainty are all invariably more difficult for those who look like me. From having to over-justify my qualifications to reassuring my overly concerned parents, Black entrepreneurship remains a challenge.

Prior to joining Calaxy, I had the privilege of attending the prestigious Wharton School of Business, and eventually, landed an investment banking job on Wall Street. Things were solid in the beginning, but as the novelty of the big leagues began to wear off, so did the rose-tinted glasses. I quickly realized that my individuality and identity—my Blackness—was something that would hinder long-term success, contrary to my mother’s persistent declarations of pride. People often assume that the most difficult part of financial work for someone like me is the work itself when, in reality, that was the least of my worries.

There is a collective overestimation of how untouchable and impressive society’s elite are. There is a multitude of brilliant minds on Wall Street, but there is also an abundance of “regular” people capable of achieving their career and financial goals. The most personally challenging facet of working in finance on Wall Street was simply life itself—life as a Black man, that is. I didn’t know what The Hamptons was. I didn’t own formal attire for black tie events. I had no familial connections in the industry that could offer advice or a job, which kept me well and truly outside the insular cliques. It was almost like I could be judged for taking the more difficult route to get to the same place, despite the fact that traditional storylines often profess the opposite. Maybe that only applies if you’re white? Once I had come to the conclusion that the vocational journeys of my superiors were inevitably unavailable to me, I knew that it was time to leave…time to pursue my own success without the limitation of antiquated systems.

The hardest part about leaving my lucrative job on Wall Street was the fact that I still had familial financial responsibilities. Instead of taking my first big paycheck and dumping it into a Rolex and European trips like many of my then colleagues, I bought my little brother his first car and paid his high school tuition. While I did those things with great pride, I felt as though my coworkers alienated me for decisions like this. Living as a social pariah on the outskirts of Wall Street made doing the job, which was supposed to be the easy part, incredibly difficult. This was just one example underpinning the fact that the hardship of this role was never about the work, but about the implications that my background had on the viability of their career. Vocational success is oftentimes a one-way street with no escape plans. For Black people, that job, degree, and upbringing will inevitably mean more to us as young Black professionals, given that those things are usually a rare chance to rewrite the narrative for ourselves.

Prior to leaving Wall Street and co-founding Calaxy, I was a securitization banker with the opportunity to focus on numerous product areas including residential and commercial real estate, along with U.S. credit. I was always the type of person to look for real-world applications for the things I learned and securitization was no exception. Due to the high attrition rates of the product areas I worked in, I got to learn and do more than the average 24-year-old. In 2018, my older brother introduced me to one of his closest friends, Spencer Dinwiddie, NBA star and blockchain enthusiast. Through this introduction and formation of a three-man team, we curated the concept for securitizing Spencer’s NBA contract, and without knowing it at the time, initiated my departure from legacy finance.

In 2019, I served as an advisor to Spencer, who became the first player in NBA history to securitize himself after an extensive battle with the Association. He put his contract on the blockchain and sold tokens to his fanbase in what was structured to be a pseudo-cash advance. With this framework, Spencer was able to partially unlock funds in his contract, while his fans were able to hold a more vested interest in Spencer and earn an incremental return. This act of securitization was the catalyst in our team realizing the endless use cases for blockchain technology. Spencer saw an opportunity to build a platform that more equitably transfers value between fans and entertainers without the need for a third party or intermediary. Thus, Calaxy was born.

Entrepreneurship requires a support system. The people that wake up every morning and check on you are quite possibly the most important factors when calculating the viability and success of your business. Anyone that’s ever independently ventured into the unknown understands the value of supportive and attentive family members and friends in bolstering confidence throughout the development of their business. In the case of many Black founders, their families are predisposed to choose safety and comfort over chasing a risky dream. Black people, who are arguably the most creative people on the planet, are often discouraged from creating vocationally given that their circumstances on average would lead them to choose the conventional 9-to-5. It comes as no surprise, when you factor this in with the other systemic challenges we consistently face, that less than two percent of more than 400 U.S. unicorn startups in the past 10 years have had Black founders.

In the months leading up to my departure from Wall Street, I had numerous conversations with loved ones and the feedback was astoundingly consistent. I would be met with an awkward, “Wow… really? You’re looking to leave and go out on your own? I’m happy for you, but have you thought about what you’d do after?” It was almost as if the endorsement I got was solely based on my ability to beat the odds up until that point in my life. In this instance, I received a yellow light at best from those around me.

The hardest part about Black entrepreneurship is showing up. The journey I’ve had to travel and the inhibitions I need to ignore to even start to build something is where the biggest battle lies. While there has been a concerted effort by numerous funds in VC to support Black founders, the reality is none of those solutions can rectify the inherent inequality that exists within their personal lives. Announcing that you have $100 million allocated to support the next generation of Black entrepreneurs is great, but what good is that if the majority of talent is hindered by their own cultural thought systems and another generation of potential Black founders never chooses to embark on the journey? Counterintuitively, that reality becomes more true for the most highly achieving Black talent given that they have been taught to rely on safety nets. Not only is it difficult for Black founders to show up, but it’s also almost as though there’s a certain indeterminable amount of adverse selection given that the cost-benefit analysis looks crazy the more accomplished you become.

Black entrepreneurship is beautiful. It’s meaningful. It’s purposeful. It’s authentic. The reality is that there is still an inconceivably long way to go until all playing fields are leveled. A recent McKinsey report that I read says, “…too often, these and other barriers lead to shortfalls—just 4% of Black-owned businesses are still in operation after three and a half years, compared with an average of 55.5% for all businesses.” That statement in itself speaks volumes.

While a truly level playing field may never be attained, Black people are still powerful beyond measure. Everything I mentioned above can be viewed as an allegorical reference for every other aspect of life as a Black person. Just like we have done and continue to do, Black people will find a way to prevail even if the odds are stacked against us. I always thought that my initial success was due to the fact my mother knew me to be a “king” who just happened to be Black. Perhaps it’s because I’m Black that she knew I’d become a “king” in spite of it all.